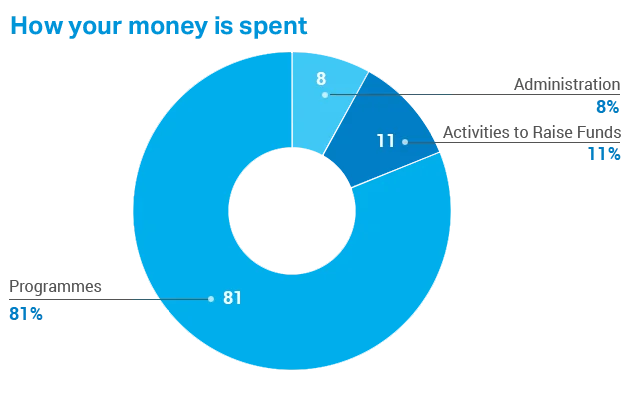

All donations to SOS Children’s Villages India are eligible for 50% tax exemption u/s 80G(5) of the Income Tax Act, 1961

Families experiencing crisis or extreme hardships may have difficulty caring adequately for their children, and often, this can lead to child abandonment. Our preventive measure whereby the families belonging to the most vulnerable sections of society, those who are lost in the quagmire of poverty, social discrimination and are facing many other challenges to make ends meet, are strengthened to avoid abandonment of children. Such families often belong to the below-poverty line category and are caught up in the vicious cycle of economic, socio and cultural deprivations.

Under these circumstances, sponsoring a child is the best way to make a lasting impact on the life of a child in need. By becoming a sponsor, you can help provide children with the basic necessities they need to thrive and reach their full potential. By virtue of which, you will have the opportunity to build a meaningful relationship with them. Your sponsorship will provide the child with access to education, healthcare and other basic needs that they may not have had otherwise.

Through our regular updates and communications, you get to see for yourself how your support is making a difference in the life of the child you sponsor. You can watch them grow and develop into healthy, confident and independent individuals.

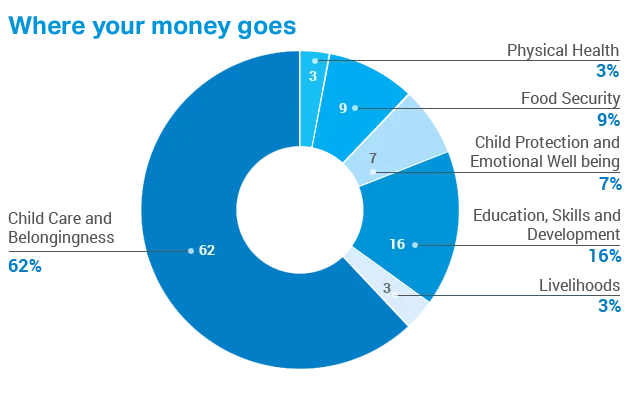

Committed to providing a caring family to every child without parental care or in the process of losing parental care, our Family Like Care and Family Strengthening Programme provides an innovative care model for children who have lost their families or are about to lose them, enabling them to grow up with love, respect and security, to realise their full potential.

Your donation will ensure that every child has a right to be nurtured to reach their full potential to become self-reliant and responsible citizens.

Regular giving (or giving monthly) helps us plan long-term projects. There is an urgent need for regular giving as the people we work with need help every day. Your regular donation allows us to implement impactful programmes which will bring about a substantial change in their lives.

You can contribute to SOS Children's Villages India through our website using your credit card, debit card, net banking and cheques or mobile payments and e-mandate.

Cheques should be in favor of 'SOS Children's Villages of India' and be posted to us.

Contact/write in to: Rahul Pawar at 011- 43239200/ sosindia.info@soscvindia.org for any query.

Stories of Change : Read Success Stories of Children We’ve Helped..

No child should be at risk of losing parental care and every child has a right to be nurtured so they may reach their full potential. Around the world, children are deprived of education and learning for various reasons. Poverty remains one of the most obstinate barriers. Children living through economic fragility are more likely to be cut off from schooling. Thousands of children in the country who are unable to go to school are deprived of education and growth opportunities for them to become contributing members of society and lead a happy life. Many of them are working in harsh conditions to earn a living, while others are falling into the darkness of crime and substance abuse.

Our Family Strengthening Programme in India aims to strengthen families to become self-reliant and reach greater dignity by ensuring holistic development of their children, building capacities and income generating skills of their caregivers. With the key objective of promoting education, SOS Children’s Villages India works towards ensuring that all children are in schools and reducing the risk of dropouts, especially during the transition phase. The focus of SOS India’s education programme is on the enrolment (access), retention, quality, remedial support, skills development and capacity development of caregivers.

Depending upon the categories of school-going children - like children who have never been to school, children who are irregular attendees, school dropouts, specific interventions are being planned, primarily focusing on academic support, counselling and mentoring, leading to better outcomes. Another integral part of this programme is our Bal Panchayat (Children's Parliament) model that gives young ones a collective voice through a democratic platform at the grassroots. Regular awareness programmes on the importance of education through various mediums, such as nukad-nataks/ street plays, video shows, songs, IEC materials, etc., are organised for caregivers.

Without quality education, children face considerable barriers to employment and earning potential later in life. The education and tuition support provided by SOS Children’s Villages India has not only helped prevent the disruption of education, but also encouraged children to continue learning, no matter what.’

Join hands with us to ensure that underprivileged children can break free of the vicious cycle of poverty, ignorance and suffering by the ray of education. Donate for Education!

You can contribute to SOS Children's Villages India through our website using your credit card, debit card, net banking and cheques or mobile payments and e-mandate.

Cheques should be in favor of 'SOS Children's Villages of India' and can be posted to us.

Contact/Write in to: Rahul Pawar at 011- 43239200/ sosindia.info@soscvindia.org for any query.

Strengthening families and communities so they can adequately care for their children. SOS Children's Villages India’s Family Strengthening Programme (FSP) empowers vulnerable families and communities including widows, single women or below poverty line families so that they can adequately care for their children. With an aim to prevent children from losing parental care or from being abandoned, we help families/individuals generate sustainable income while building their capacity to ensure that the children are well cared for and their basic rights to education, skilling, health and nutrition are fulfilled.

The Family Strengthening Programme has specific interventions like livelihood programmes, sustainable income generation and parenting skills initiatives, wherein the support offered by SOS India extends to over half a decade. Under the programme, we work towards

Our Family Strengthening Programme helps us to keep the biological families together and touches the lives of nearly 38000 children across 28 locations. Self Help Groups (SHGs) are a key element of the programme that empower caregivers towards attaining self-reliance, thereby securing financial independence, enhancing self-worth and enabling wholesome childcare and development.

Your donation will ensure that no child is at the risk of losing parental care and every child has a right to be nurtured so that they may reach their full potential to become self-reliant and responsible citizens.

You can contribute to SOS Children's Villages India and/or sponsor a child through our website using your credit card, debit card, net banking and cheques or e-mandate.

Cheques should be in favor of 'SOS Children's Villages of India'.

Contact/Write in to: Rahul Pawar at 011- 43239200/ sosindia.info@soscvindia.org for any query.

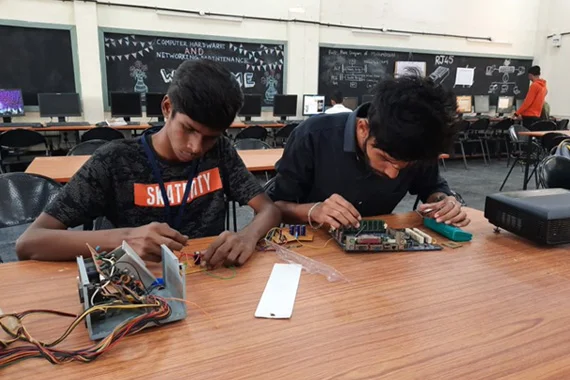

Providing vocational and life skills to youth, thereby empowering them towards dignified living, productive employment and self-reliance.

Equipping young people with the skills and confidence to support them to walk the path of independence is a key focus area under our programmes. Through various youth skilling and development initiatives, we equip young people with the right expertise and confidence they need to realise their potential. We strive to provide quality and value-based education to children, and support youth under our care with skilling in order to secure productive employment for them and make them responsible citizens. We seek to invest in young people’s capabilities to develop future societies, which are sustainable and informed.

Donate now to support skill training, employment and a dignified livelihood for underprivileged youth. Give them and their families a chance to step above the poverty line!

You can contribute to SOS Children's Villages India and/or sponsor a child through our website using your credit card, debit card, net banking and cheques or e-mandate.

Cheques should be in favor of 'SOS Children's Villages of India'.

Contact/Write in to: Rahul Pawar at 011- 43239200/ sosindia.info@soscvindia.org for any query.

Your donation can bring about transformational changes in the lives of entire families, including women, children and the communities they live in

You can contribute to SOS Children's Villages India and/or sponsor a child through our website using your credit card, debit card, net banking and cheques or e-mandate.

Cheques should be in favor of 'SOS Children's Villages of India'.

Contact/Write in to: Rahul Pawar at 011- 43239200/ sosindia.info@soscvindia.org for any query.

All donations to SOS Children villages India are eligible for 50% tax exemption u/s 80G(5) of the Income Tax Act, 1961.

Please Note: For any enquiries/support, kindly mail us at sosindia.info@soscvindia.org

Data privacy: We take utmost care of your personal information and will never share or sell your details to third parties. All your sensitive information like credit card or bank details are not stored in our system and we never call donors to ask for their Debit or Credit Card PIN or Net banking password.

Recreating family like environment for 6,500 + children with a stable caregiver and social relationships

38841 direct beneficiaries (Below 18yrs children, VT Youth & primary caregivers)

Ensuring 513 children grow up in natural cultural environments (in 325Kinship families)

38 short stay homes are operating in 28 Children's Villages

8602 children and 13320 families supported last year

956 youth completed skill training programme 237 youth secured first time employment

50 children welcomed in a foster family

115 children cared for in a loving environment